As an emerging market, it is well known that cryptocurrency is still in the blue ocean stage and there are many opportunities.

However, many people equate cryptocurrency investment with trading, which is not the case.

Trading is just one way to play cryptocurrency. There are many other ways, including zero-investment methods and methods that require a lot of money. There are simple methods suitable for lazy people and more complex methods suitable for people with professional knowledge and high risk tolerance.

However, no matter which method you play, as long as it suits you and can make money, it is a good method.

Next, we will introduce 10 ways to make money quickly by playing cryptocurrency, but the method of earning Bitcoin for free may not be very effective, because “nothing is free” in this world.

To get Bitcoin, you need to invest a lot of time and energy, and the returns are very low or just a waste of time. Therefore, you can understand it, but it is not recommended to invest too much energy. Finally, there are 5 most effective ways to make money from cryptocurrency, which I think are worth studying.

First, let’s take a look at some ways to make money with cryptocurrency.

| Ways to Earn Free Bitcoin | Method 1: Receive airdrops Method 2: X to Earn (play cryptocurrency games) Method 3: SocialFi Method 4: Create NFTs |

| Effective ways to make money from cryptocurrency | Method 5: Mining with mining machines Method 6: DeFi mining Method 7: Deposit coins to collect interest Method 8: Buy low and sell high Method 9: Futures contracts Method 10: Arbitrage |

Ways to Earn Cryptocurrency For Free

Method 1: Receive Airdrops

Airdrops, to put it simply and rudely, are free gifts of cryptocurrency. There are generally two forms: active and passive.

Active airdrops require you to do tasks for the project, such as registering an account, interacting on the chain, etc., in order to get token incentives.

However, passive airdrops do not require you to do anything, as long as you hold a certain token, you can get rewards, such as the BCH airdrop for holding Bitcoin (BTC) in 2017, and the ETHW airdrop for Ethereum holders after the Ethereum merger in 2022.

- Pros: No additional investment is required, get cryptocurrency for free.

- Cons: Time-consuming (active), low success rate (passive), tokens may not be valuable.

- Suitable for People: Newbies who don’t dare to invest real money but have plenty of time.

- How to Play: At present, airdrops are not just the behavior of individual users, but some teams have already started to scale up. Therefore, you can pay more attention to some KOLs’ social media such as Twitter and Instagram, or join Telegram or Discord groups to quickly obtain high-quality projects through them. The specific process is different for each project, but there will be operation guides, so don’t worry about not knowing how to play.

Method 2: X to Earn (Playing Games with Cryptocurrency)

X is an unknown number in mathematics, which represents a variable. “X to Earn” refers to the cryptocurrency rewards obtained by completing tasks, including Play to Earn, Move to Earn, Watch to Earn, Write to Earn, etc. These are mainly in the GameFi field, and the popular projects include Axiety Infinty and STEPN.

- Pros: It combines sports, entertainment and making money.

- Cons: Generally, you need to pay to buy props and equipment. As the number of people increases, the rewards will decrease and depreciate, and they are often controlled by the game guild.

- Suitable for People: Gold farming expert and game player.

- How to Play: Prepare a wallet, then find the project’s official website, connect the wallet (equivalent to registering a game account) and start playing.

Method 3: SocialFi

SociaFi = Social + Finance. It combines social activities with finance. Through social activities, such as creating content, liking, commenting, reposting, etc., you can get rewards in cryptocurrency.

- Pros: Any player with creative ability can join, no investment is required.

- Cons: Token prices are poor, unknown creators find it difficult to get rewards, there is a lack of high-quality content, plagiarism is rampant, and projects lack a business model.

- Suitable for People: KOL, social enthusiast.

- How to Play: If you are a creator, you can publish content on platforms such as Mirror and Twitter and get rewards from fans. If you are an ordinary user, you can choose other platforms, such as Audius, and get rewards through sharing, liking and other interactive activities.

Method 4: Create NFT

Many well-known NFTs, such as Bored Ape Yacht Club and Azuki, were created and sold by teams and earned considerable income.

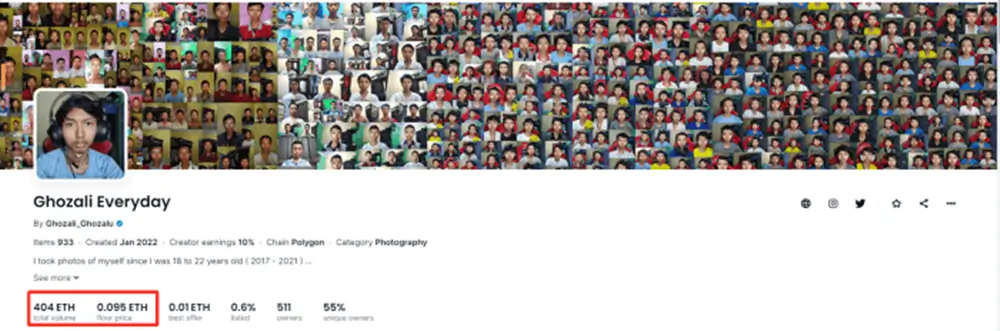

However, individuals can also create NFTs and sell them on NFT platforms. Among them, an Indonesian man made his selfies from the age of 17 to 21 into NFTs and sold them. The transaction volume reached 400 ETH, with the lowest price being 0.095 ETH.

- Pros: Anyone can create it without any restrictions. The work can be paintings, music, performances, etc., and supports multiple forms such as photos, videos, and audio.

- Cons: Maybe no one will buy it, it lacks application value, requires professional knowledge, and freezing data requires gas fees. Some countries do not allow NFT trading, and there are certain legal risks.

- Suitable for People: A well-known person who has artistic talent or a certain number of fans.

- How to Play: Prepare original artwork and wallet, then choose NFT platform such as Opensea, Rarible, etc., and upload the artwork by connecting the wallet to the platform. Note: Be sure to keep the wallet private key or mnemonic, otherwise these NFT assets will be lost.

Best Way to Make Money From Cryptocurrency

Method 5: Mining with a mining machine

Generally speaking, mining by mining machines refers to mining cryptocurrencies using professional mining machines, including Bitcoin (BTC), Litecoin (LTC), Filecoin (FiL), etc. There are generally two forms: buying mining machines to mine, or entrusting them to a third party.

- Pros: The output is relatively stable and does not require daily monitoring. It is a form of passive income.

- Cons: The payback period is long, the legal risks are high, the capital monopoly is serious, and the investment costs are high.

- Suitable for People: Institutional investors have very cheap electricity resources.

- How to Play: If it is entrusted to a third party, you do not need to operate it yourself. You only need to prepare a wallet address to receive cryptocurrency. It should be noted that you must confirm that the mining machine or the third party is authentic and reliable. If you mine by yourself, you need to find a remote, low-temperature, low-electricity place. After placing the mining machine, you also need to download the mining software. Generally, when you purchase a mining machine, the seller will provide a specific operation process.

Method 6: DeFi Mining

Usually, mining requires mining machines or computing power, but DeFi mining does not. DeFi mining refers to making contributions to decentralized finance (DeFi), such as adding liquidity, mortgage lending, leasing, trading, etc., and receiving cryptocurrency as a reward. It mainly includes liquidity mining, lending mining, trading mining, etc.

UbitEX: Make Money From Staking and Affiliate

- Pros: The rewards are relatively generous and the coin price usually performs well.

- Cons: It requires high professionalism and involves the risk of loss.

- Suitable for People: Financial professionals

- How to Play: Find the official website of the DeFi platform, such as DEX (Uniswap) and lending (Compound), then choose the product according to the currency you hold. If you don’t know how to operate, you can find the operation manual through the project’s Gitbook, which generally has a detailed guide. Since DeFi has a high risk factor, you must study its potential risks and not blindly rush in for mining rewards. Pay special attention to mortgage lending. Price plunges often trigger liquidation risks, which may not be worth the loss.

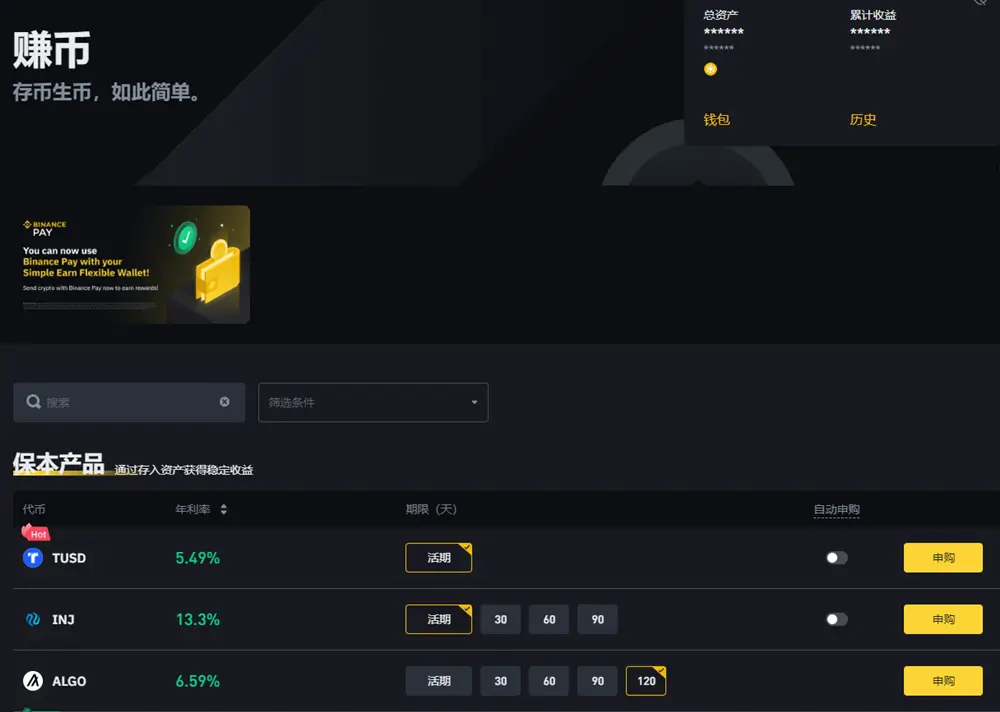

Method 7: Deposit Coins and Receive Interest

This is similar to the deposit business of a bank. You will earn interest by depositing coins into the platform. There are two main types: demand deposit and fixed deposit. Demand deposit can be withdrawn at any time, while fixed deposit can only be withdrawn when it expires. Generally speaking, the more coins you deposit and the longer the time, the more interest you will get.

- Pros: The operation is simple, there is no threshold restriction and the risk is relatively low.

- Cons: The profits are low and the interest may not offset the risk of the coins’ falling prices.

- Suitable for People: Long-term investors and coin holders

- How to Play: Such products are generally launched by centralized exchanges, such as OKX and Binance. You can find the corresponding products and apply for them through the official website.

Method 8: Buy Low and Sell High

This is the easiest way to make money with cryptocurrency. Similar to stock trading, cryptocurrency can also be bought low and sold high to make a profit, usually referred to as spot trading. Spot trading generally requires time, that is, medium- to long-term holding. If you pursue short-term swing trading, the risk will increase, and the loss will be large when the market falls, and the profit will be limited, unless the capital volume is large.

- Pros: The threshold is low, the operation is simple, and it is more stable than futures contracts.

- Cons: It requires investment, certain trading knowledge, and patience.

- Suitable for People: Short-term trading is suitable for trading enthusiasts and professional traders, while long-term holding is more suitable for novices.

- How to Play: Register an account, verify your real name, top up, and buy and sell on the exchange. It should be noted that you must choose a reliable cryptocurrency trading platform.

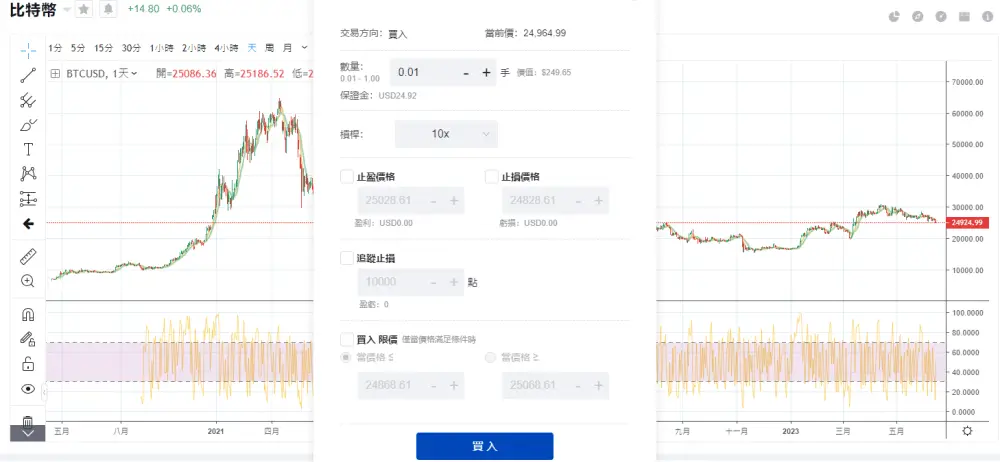

Method 9: Futures Contracts

Cryptocurrency was born in 2008, but futures contracts did not appear until 2018. After its launch, it has been warmly welcomed by users. Cryptocurrency futures contracts only require a small amount of margin to open leveraged transactions, and the trading direction can be long or short. This method is more exciting because it is a high-risk and high-return strategy that allows traders to have the opportunity to profit from both rising and falling prices.

- Pros: Support long and short positions, high returns, and small investments for big gains.

- Cons: The risk is high, and there is a possibility of liquidation, which may lead to the principal being zeroed out. It requires a very high trading psychology. It does not meet the long-term goals.

- Suitable for People: Aggressive investors are willing to take losses and pursue high returns.

- How to Play: There are different types of cryptocurrency contracts. You only need to choose a trading platform to open an account, monitor market trends and trade when necessary. The trading method is similar to spot trading, so you can refer to the above content. When operating, you need to pay attention to the leverage ratio, position size, and stop loss and stop profit.

Method 10: Arbitrage

Generally, the same coin has different prices on different exchanges/platforms. If the price difference is too large, there is an opportunity for arbitrage trading. Simply put, you can buy on an exchange with a low price and immediately sell on an exchange with a high price. Note that if the price difference is not large enough to cover the transaction fees, withdrawal fees, etc., it may result in losses, which means arbitrage failure.

- Pros: Low risk and stable returns

- Cons: There are fewer opportunities and you need to be fast. Once the operation is slower, the price difference may disappear.

- Suitable for People: Users with large amounts of capital who are sensitive to prices and skilled in operations.

- How to Play: Arbitrage is the superposition of spot trading, deposit and withdrawal. It is not difficult to operate. However, it is generally necessary to pre-register on multiple platforms, otherwise it will be too late to register after discovering the price difference.

Conclusion

So, how do you make money from cryptocurrencies? In fact, there are many ways, and the key is to find the one that suits you best. Before testing, we need to carefully evaluate our capital scale, risk tolerance, and operating experience. And in the early stages of testing, try to participate only with a small amount of money. As your proficiency increases, you can increase your funds to gain more profits. But never use the money you can’t afford to lose.

The above are the 10 ways I introduced to you to make money through cryptocurrency. Which one do you think is more suitable for you?