Expand Summary

Ray Dalio, the 123rd richest person in the world, attributes his wealth to understanding the principles of delayed gratification, akin to those demonstrated in the Stanford Marshmallow Experiment, and advocates this approach for others to achieve wealth.

Abstract

Ray Dalio, founder of Bridgewater Associates, believes that the ability to delay gratification is a key determinant of wealth accumulation, drawing parallels to the Stanford Marshmallow Experiment which linked delayed gratification to future success. Dalio’s journey began with a fortunate introduction to investing at a young age, leading to his first successful investment. His hedge fund, Bridgewater Associates, notably navigated the 2008 financial crisis by anticipating market trends and adjusting investments accordingly. Dalio emphasizes that saving and investing, rather than immediate spending, are crucial steps towards building wealth, and he encourages individuals to consider long-term financial strategies.

Opinions

- Dalio suggests that the principle of delayed gratification is fundamental to building wealth, especially when individuals have equal opportunities.

- He points out that not all opportunities are equal globally, but for those with similar starting points, the ability to save and invest is a differentiating factor.

- Dalio’s success story, including his hedge fund’s performance during the 2008 financial crisis, exemplifies the importance of foresight and strategic financial planning.

- The article implies that Dalio’s approach to investing, which involves saving and considering the long-term implications of financial decisions, can lead to significant returns over time.

- The article does not provide specific investment advice but emphasizes the transformative potential of investing in growth stocks and similar assets over a long period.

- It is noted that individuals should seek professional financial advice before making significant investment decisions.

He once paid a stripper to dance for cattle ranchers and farmers before showing them how to hedge risk with their investments.

Sometimes in life, you need a little luck.

Ray Dalio’s golden ticket was caddying at his local golf course, where he’d carry the golf bags of Wall Street professionals.

He’d listen to the conversations and sometimes even get invited to dinners. It resulted in him making his first-ever investment in Northeast Airlines for $300, which tripled in price after the airline merged with another company.

Adjusted for inflation, $300 was the equivalent in purchasing power to about $2,978.01 today. It was 1961, and he was 12 years old.

From that moment, Dalio became hooked on investing.

He’s now the World’s Best Hedge fund manager, with a reported net worth of $19.1 Billion. He founded a hedge fund from his two-bedroom apartment, which is now the largest hedge fund in the world.

Dalio and his friends created the company that later became Bridgewater Associates, which quickly snowballed, picking up big clients like Mcdonalds, The World Bank and Kodak.

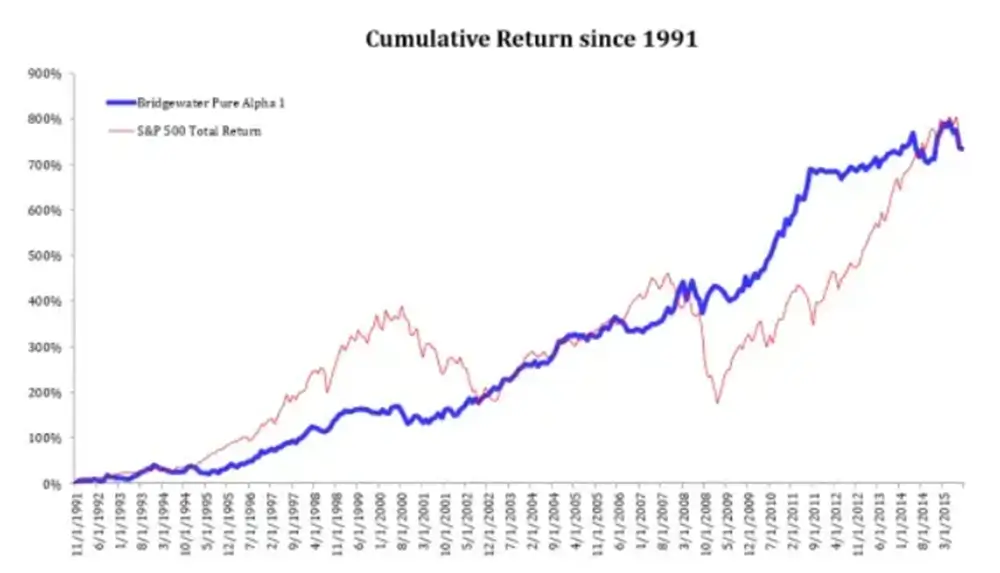

Bridgewater Associates famously avoided the stock market capitulation in 2008, which you might remember ended up being a disastrous year for the entire stock market.

Dalio’s competitors were getting nuked while he managed to grow the company’s value by 9.5% by foreseeing the housing crash in 2008, which very few did.

He anticipated that the Federal Reserve would print more money to revive the economy and negatively impact the dollar. So he shorted the American dollar and invested heavily in Treasury bonds, Gold and other commodities before the crash.

The deleveraging process led to measures that helped the firm anticipate the crisis as early as 2006.

As the subprime mortgage market unravelled the following year, Bridgewater Associates warned readers in their “Daily Observations” newsletter about the “crazy lending and leveraging practices.”

Ray Dalio and his company were spot-on with their analysis. The global banking industry lost more than $500 billion in 2008.

Meanwhile, Bridgewater Associates crushed it.

Investors flocked to the firm, whose hedge fund assets exploded from $36 billion to $85 billion at the start of 2008.

You can see in the below chart the Bridgewater Associates’ returns compared to the S&P 500, which is an index of the largest 500 companies in the United States.

You Must Understand the Stanford Marshmallow Experiment.

Walter Mischel was a psychologist who led a study on delayed gratification at Standford University (Stanford Marshmallow Experiment).

In this study, a child was offered a choice between a small but immediate reward or two small rewards if they waited for a while.

During this time, the researcher left the room for about 15 minutes and then returned. The reward was a marshmallow or pretzel stick, depending on the child’s preference.

In follow-up studies, the researchers found that children who could wait longer and delay gratification for the preferred rewards tended to have better life outcomes.

Researchers measured these life outcomes by SAT scores, educational attainment, body mass index and other life measures.

Ray Dalio Says the Marshmallow Test Is Your Answer to Becoming Wealthy.

In interviews, and as a wealthy man, Dalio gets asked why some people make vast wealth and others don’t.

Why are people extremely wealthy while others are constantly stuck, not knowing how to save, invest and create wealth?

Ray Dalio — Source

“I want to distinguish that there’s a big difference in people’s opportunities worldwide, but if you compare two people with equal opportunities. When it comes to money, it’s delayed gratification that separates them.

Once you realise that deferred gratification will improve you, you begin to count and say how many days, months, weeks, or years can I live if I don’t spend the money I have coming in”.

Dalio relates delayed gratification to the Stanford Marshmallow test but did make the distinction that equality of opportunities isn’t equal in every scenario and caveated it by saying you’ll see differences in outcomes for “people with comparable circumstances.”

“Like the marshmallow test, you must delay gratification with your finances.

When you save, the next natural question you ask yourself is, where should I hold, and where should I keep this money?

When it comes to money, and you don’t spend it for instant gratification, it means you’ve got savings.

The next thing that comes at you is, what do I do with my savings?

Now you experience something different with the money you have, compared to the person who spends it straight away”.

Final Thoughts.

Like most world-class performers, Ray Dalio can explain complex topics and simplify them in a way you can understand.

He’s right. Delayed gratification is the most significant indicator of financial success because when your savings are building up in your bank account, you have a completely different conversation with yourself.

Like, where should I keep this money?

You could invest.

Well, in what?

What Dalio doesn’t do is give investment advice and tell you where you should invest your money. But the concept of his message is profound.

If you live in America, the average take-home salary is $3200 after tax. You’d have earned significant returns if you invested half, so $1600, into a growth stock for just one month and left it there for ten years.

The average salary take-home pay is only 2 dollars higher now than ten years ago.

If you had invested in Amazon, for example, you would have enjoyed returns of 740% and made just under $12000 in profit.

There are countless companies where we use their products and services daily that have grown like this, even after market corrections.

You should decide your best strategy and have a different conversation with yourself.