The Inflation Challenge and Market Dynamics

As inflation continues to be a significant concern globally, many are questioning just how high it could get and what the resulting impacts might be. Central banks, particularly the Federal Reserve, have been heavily involved in trying to manage inflation, often by price-fixing key aspects of the economy. This intervention has led to speculation about what could happen next, including the potential for civil unrest as economic pressures mount.

Bitcoin’s Promising Future

Amid these challenges, Bitcoin has been positioned as a beacon of financial opportunity. Analysts and enthusiasts alike have been predicting that Bitcoin could surge to anywhere between $250,000 and $1 million.

The cryptocurrency has recently shown signs of recovery, bouncing back from lows around $49,000. This upward trend seems to be driven by broader market dynamics, including the potential for one of the greatest asset bull markets in history.

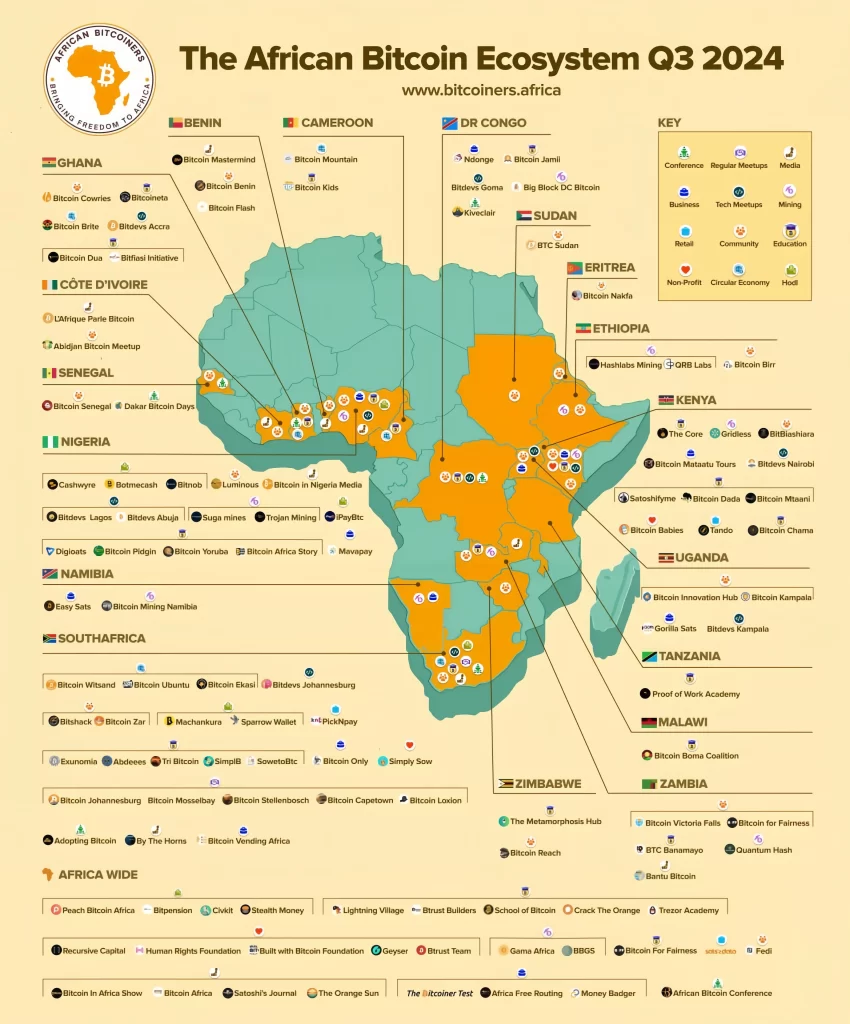

Despite recent outflows from U.S.-based Bitcoin ETFs, global accumulation of Bitcoin remains strong. Countries like Australia are continuing to build their Bitcoin reserves, and over 110 businesses in Africa are now actively involved in Bitcoin-related ventures. This suggests that Bitcoin’s global appeal is only growing, even as it faces periodic market dips.

Central Bank Policies and Their Impact

Central banks have played a crucial role in shaping the financial landscape, particularly through their approach to monetary policy. The Federal Reserve, for example, has been criticized for not allowing the natural business cycle to run its course, often intervening to prevent economic pain. With the next Federal Reserve meeting scheduled for September, there is growing anticipation that the Fed might lower interest rates to stimulate the economy further.

This potential rate cut could have significant implications for Bitcoin. As cheap capital flows into the market, risk assets like Bitcoin are expected to benefit. The Fed’s previous actions, such as the two emergency rate cuts in 2020, demonstrate their willingness to take aggressive measures to stabilize the market.

The Role of Quantitative Easing

Quantitative easing (QE) is another tool that central banks may deploy to manage economic downturns. The next round of QE is not a matter of if, but when. Should central banks engage in large-scale money printing, the volume could be astronomical, potentially triggering multiple cycles of monetary expansion. This scenario would likely push Bitcoin and other cryptocurrencies higher, as they are often seen as hedges against inflation and currency devaluation.

The Altcoin Landscape

While Bitcoin remains the flagship cryptocurrency, altcoins like Caspa and Solana are also making waves. Solana, in particular, has gained attention for its role in the crypto gaming industry.

The first blockchain game on PlayStation 5, “Off the Grid,” has already seen significant traction, with 400,000 transactions from over 30,000 players during a recent playtest. This milestone reflects the growing interest in blockchain-based gaming and the potential for Solana to capitalize on this trend.

Caspa, another altcoin, is gaining momentum, with Marathon Digital—a prominent Bitcoin mining company—investing in Caspa miners. Marathon Digital’s CFO, Salam Khan, has described Caspa as a high-margin product with the potential for significant returns. This investment strategy reflects a broader trend of diversification within the crypto space, where companies are looking beyond Bitcoin to explore new opportunities.

Political Developments and Crypto Regulation

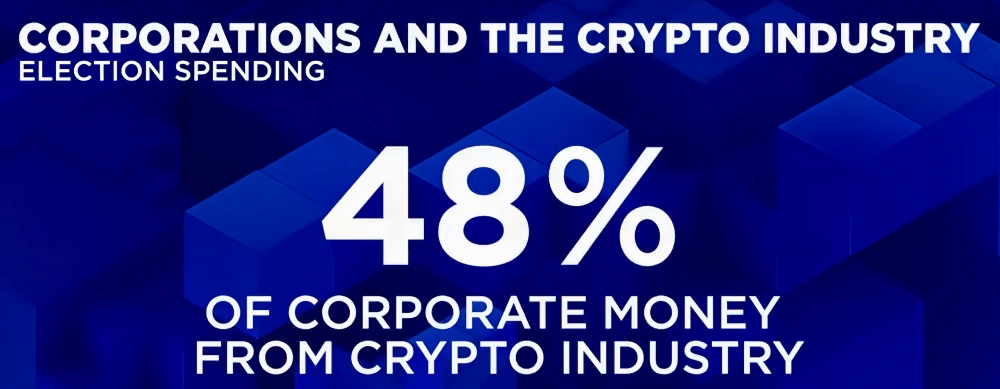

The political landscape also plays a crucial role in shaping the future of cryptocurrencies. With the U.S. presidential election on the horizon, many are speculating about how different candidates might influence crypto regulation.

Former President Donald Trump, for example, is seen by some as a pro-Bitcoin candidate, which could drive Bitcoin prices higher if he is reelected.

Meanwhile, current Vice President Kamala Harris has been engaging with the crypto community. Her team has reportedly been meeting with Coinbase executives, signaling a possible shift towards more crypto-friendly policies. Should Harris take decisive action, such as replacing SEC Chair Gary Gensler, it could mark a significant turning point for the industry.

Conclusion

The financial world is at a crossroads, with inflation, central bank policies, and political developments all playing critical roles in shaping the future. Bitcoin and other cryptocurrencies are poised to benefit from these dynamics, offering both risks and opportunities for investors. As the market continues to evolve, staying informed and prepared will be key to navigating this complex landscape.