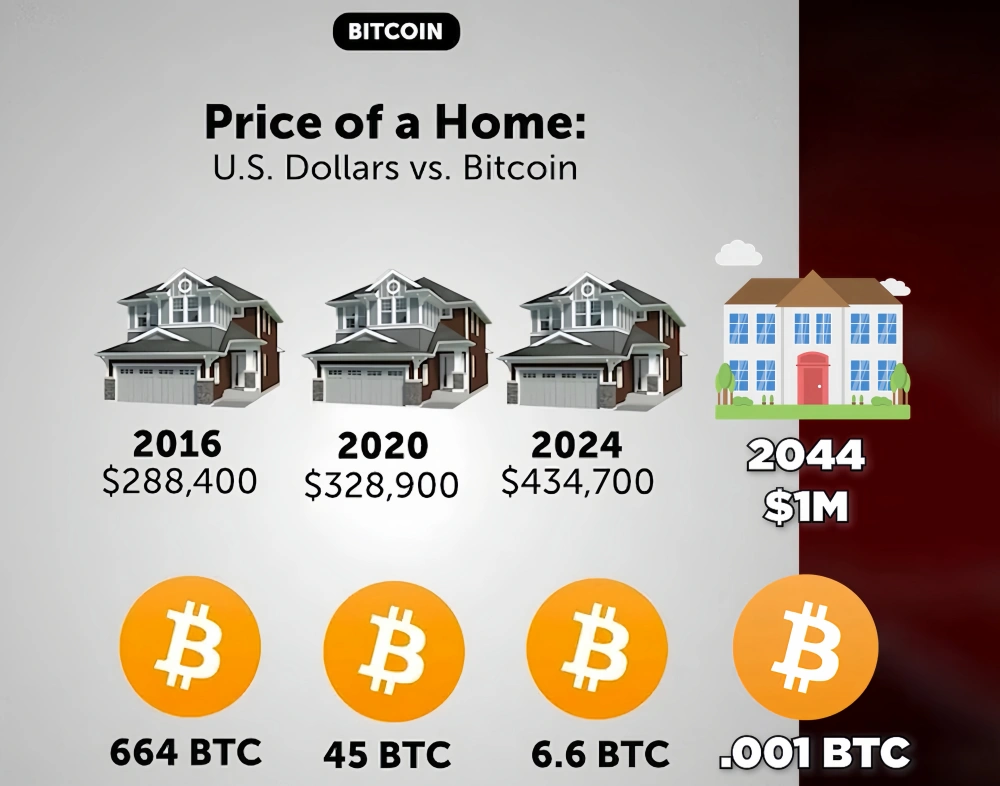

Real estate is already crashing really hard against Bitcoin. The era of real estate dominance may be over. But how much Bitcoin does someone need to accumulate to buy a home in, say, 20 years? I believe this is a completely misunderstood asset, and I’ll explain why owning even a small amount of Bitcoin could be a big deal.

The Value of 0.1 Bitcoin

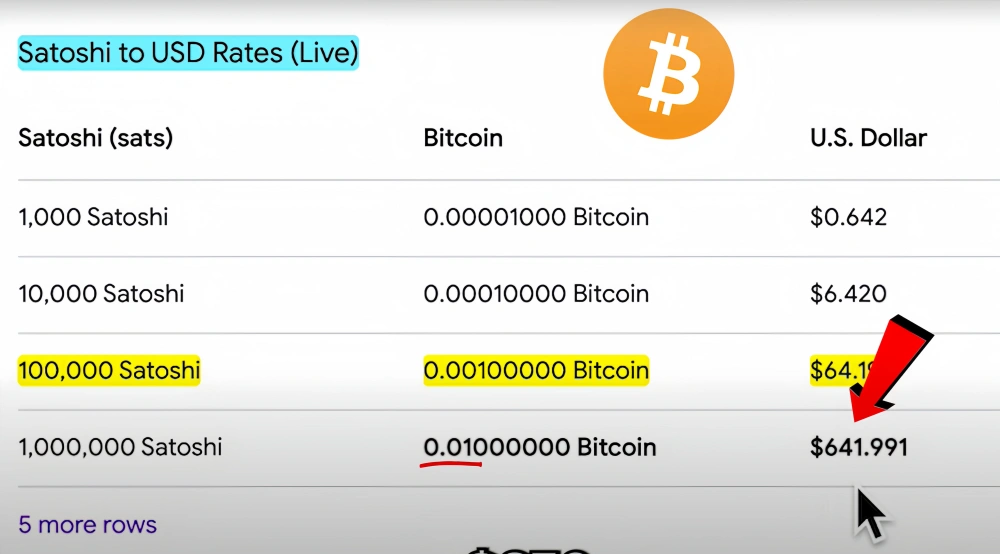

Today, owning 0.001 Bitcoin is actually a significant investment. It’s worth about $65, and if you can, you should aim to get 0.01 Bitcoin (about $650). However, if that’s out of reach, owning just 0.001 Bitcoin is all you really need, and in this article, I’ll explain why.

Why You Should Own Bitcoin

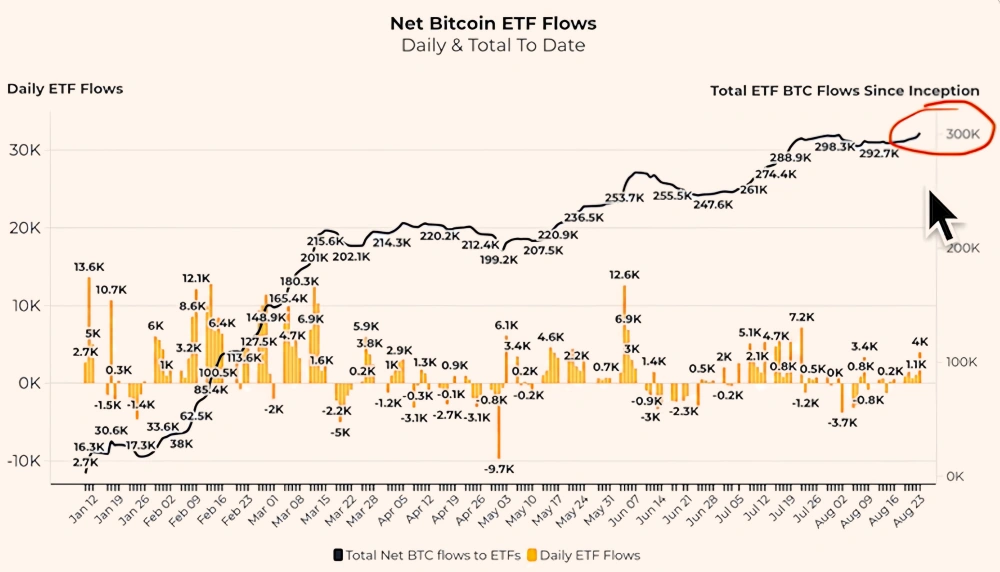

Did you know that BlackRock is secretly buying Bitcoin behind the scenes? Yes, BlackRock has a Bitcoin ETF, allowing others to buy Bitcoin through them. Over $20 billion in Bitcoin has flowed into the BlackRock ETF alone, not to mention all the ETFs in total, which have reached a new all-time high today. In fact, 300,000 Bitcoin have been absorbed into these ETFs.

BlackRock has steadily been accumulating Bitcoin, regularly increasing their holdings. Recently, they bought 4,000 more shares of their own Bitcoin ETF, bringing their total to 16,000 shares. And this is just what the company owns—we don’t know how much Bitcoin they personally own.

Bitcoin as a Store of Value

You might be wondering: “Can Bitcoin really be a good store of value?” Well, it’s like digital gold. If people believe it can be an asset that transcends borders, it could be a great long-term store of value, especially in countries where people fear government control or currency devaluation.

The Future Cost of a Home in Bitcoin

Now, let’s assume the cost of a home in 20 years will be around $1 million. According to investing expert Peter Dunsworth, speaking on the Robin Seir Daily Bitcoin Podcast, 0.001 Bitcoin could get you that home in 20 years. And if you don’t want to wait that long, 0.01 Bitcoin might get you that home much sooner.

Real Estate vs. Bitcoin Over Time

Real estate is already crashing really hard against Bitcoin. Five years ago, the average home price in the U.S. and U.K. was around 30 Bitcoin. Now, it’s around 5-6 Bitcoin. This represents a massive crash in just five years. If this trend continues, you might only need 0.001 Bitcoin to buy a home in 20 years.

A Misunderstood Asset

Bitcoin is a completely misunderstood asset. Its volatility, often seen as a bug, is actually a feature. This volatility gives Bitcoin the potential to be worth $100 million or even $1 billion in the future. Some speculate that in 20 years, the average European home price could be around €1 million, which might be equivalent to just 0.001 Bitcoin.

The Demographic Shift

The demographics for investing in real estate are changing. The Baby Boomers, who hold 80-90% of the real estate wealth, don’t realize that Millennials and Gen Z are not as interested in owning huge homes and tying up large amounts of capital. Instead, they’re more interested in experiences, flexibility, and investing in Bitcoin.

Real Estate: A Fading Investment?

Let’s consider an example from Australia. To purchase a really nice home, you might need around $10 million. Plus, you’ll have to pay a stamp duty of $700,000 to $800,000. In total, it could cost you around $11 million. You might finance 50% of it, leaving you with a $5 million mortgage at an interest rate of 6-7%. That’s going to cost you $350,000 a year in mortgage payments.

Alternatively, you could rent that lifestyle for 1-2% of the property’s value, saving the $5 million and investing it in Bitcoin. This investment could yield a 50% return per annum, earning you $25 million a year while saving $150,000 in annual property costs.

Conclusion

The Baby Boomers might not understand what’s coming. There’s no one to buy their big properties at the level needed to maintain their values. Either we need very loose credit policies with low interest rates, or we shift to investments like Bitcoin, where the demographics and population trends are more favorable.

So, there you have it—0.1 Bitcoin might be all you need for the future. The story of Bitcoin and real estate is still unfolding, so stay informed and consider the potential of Bitcoin as a key investment.

As reported in previous articles, nearly half of the funds in the US elections come from cryptocurrencies. This also reflects that cryptocurrencies are gradually penetrating into the government and are eventually accepted.