In the ever-fluctuating memecoin market, a few tokens have shown promising price trends. Screenshots of high returns on memecoin investments have started to circulate within the community, but behind these success stories are many who have repeatedly faced defeat.

The memecoin market is a landscape of both opportunities and challenges. Success requires more than just luck; traders need a well-rounded skill set, including market insight, proficiency with technical tools, mental resilience, and the ability to adapt quickly to changes. Among these, mastering the use of tools can be achieved relatively quickly.

To support traders interested in the memecoin market, we have compiled a list of on-chain analysis tools specifically designed for trading memecoins, particularly those with smaller market capitalizations and shorter histories. This guide aims to assist traders looking to navigate the memecoin market effectively.

Before diving into this article, it’s important to recognize that there are many memecoin trading tools available. Some have established loyal communities and focus on maintaining these existing networks, often reducing their presence on social media. Others are newer, offering innovative features but struggling with stability. Additionally, some tools, due to their large user bases, require careful interpretation of the signals they provide.

It’s also crucial for readers to understand the nature of the memecoin market: trading is fast-paced, and while the potential for high returns is tempting, it comes with significant risks. This market isn’t suitable for everyone. Trading tools can only serve as a support, helping to reduce the chances of falling into traps, but they cannot eliminate the risks entirely.

Getting Started: CA Address Analysis and Holdings

For traders new to memecoins, a common scenario is encountering a new token in the community and analyzing it from various angles—such as security and token distribution—before deciding whether to trade. In this process, website tools and trading bots can be valuable aids.

The first step is to conduct basic information analysis.

Pay close attention to the security of the token contract, checking for potential risks like whether the token is a honeypot, if the contract is open-source, whether token permissions have been renounced, and if there is a locked liquidity pool. Additionally, key indicators such as the token’s market capitalization, the number of holders, recent transaction activity, and the distribution of tokens among the top 10 holders are essential for assessing the token’s safety when other signals are absent.

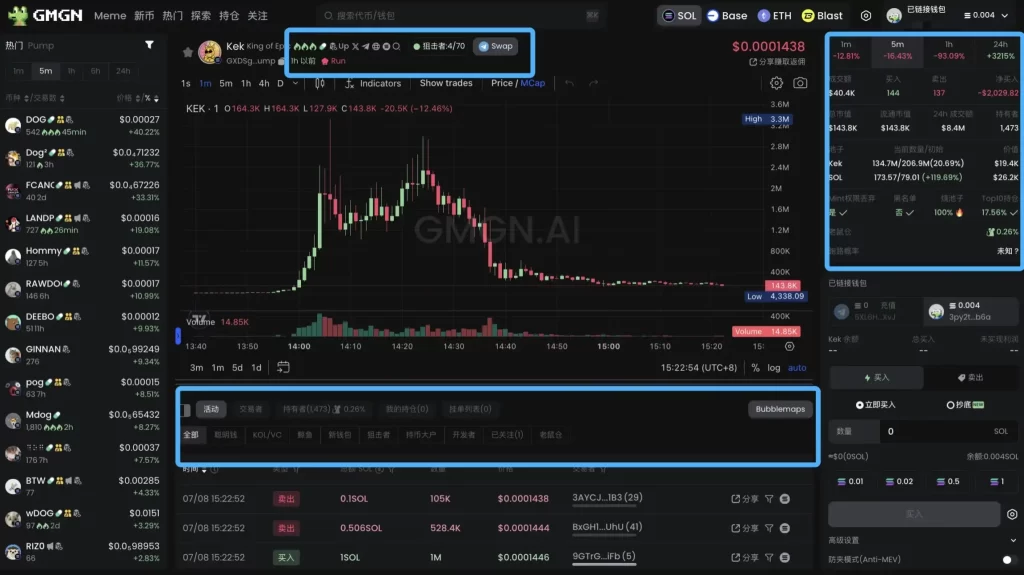

Furthermore, tools like GMGN can provide additional insights on memecoins directly on their webpage, such as whether the developer has abandoned the project, whether the team has invested in advertising on Dexscreener, and links to the token’s official Twitter account and Telegram community. The significance of this information can vary depending on the specific context.

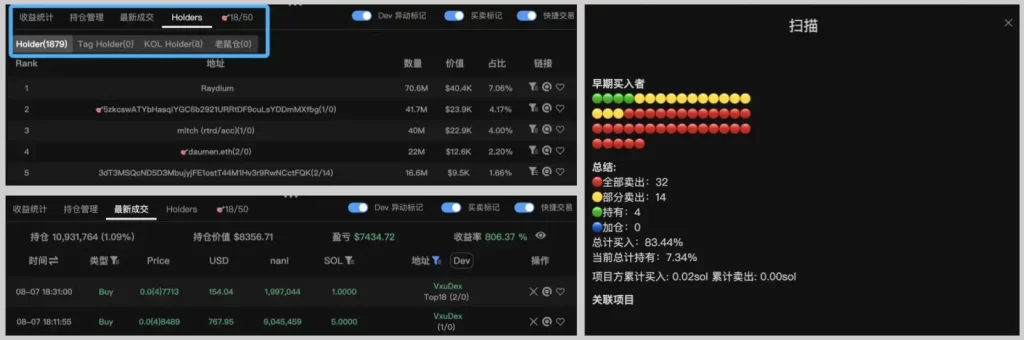

In the increasingly competitive memecoin market, where peer-to-peer (PVP) dynamics are intensifying, a deeper analysis of token holding structures is crucial. Typically, the trading behavior of smart money, key opinion leaders (KOLs), and large holders offers more actionable insights than the activities of average traders. For instance, GMGN categorizes token traders into groups like smart money, KOLs, whales, new wallets, snipers, large holders, and small-scale positions.

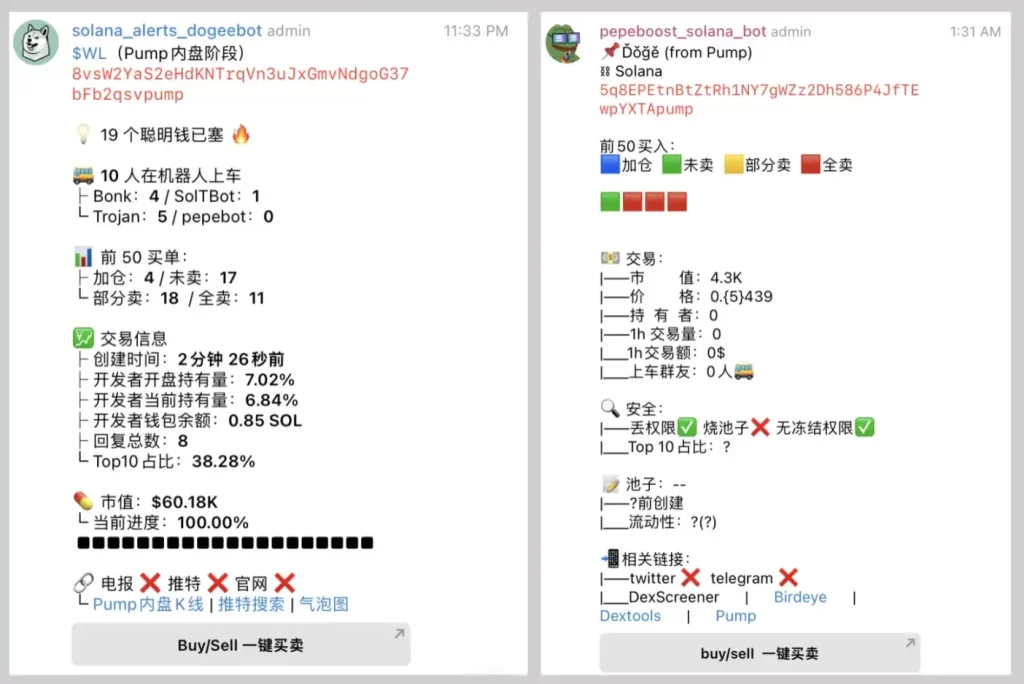

Additionally, some TGBOT-based monitoring tools can provide similar functions. If speed is your priority, you can quickly input the contract address (CA) into a group with TGBOT to instantly view token holdings.

By observing the purchase amounts, entry timing, and profit levels, and combining this data with social media discussions, you can better assess the current stage of a memecoin. Various tools on the market offer different strengths; for instance, some specifically highlight the holdings of KOLs and large investors.

Advanced Gameplay: Filter Addresses to Increase Certainty

In the memecoin market, there are several public smart money addresses, such as those with high success rates circulated within the community, addresses tagged by institutions, and KOL addresses. GMGN has identified some smart money addresses based on statistical analysis. However, publicly marked addresses and KOL addresses should be approached with caution, as blindly following them is not advisable. To navigate the market more effectively, memecoin traders should create their own smart money watchlist. This can be done using GMGN and other customized tools.

When you spot a memecoin showing strong growth, look for smart money in three categories: early large holders, high-yield traders, and early buyers. The key is to consider the timing of their purchases—if an address bought in before the coin’s rise, its actions hold greater significance as a reference point.

Some tools are more concise and intuitive in terms of viewing, and the interactive experience is more convenient. They only provide three indicators: large currency holders, KOL and rat positions. After clicking on the address, you can immediately view the transaction operations of this address on the current token without jumping. Profitability.

After identifying a batch of wallet addresses, it’s important to observe their recent transactions and profitability. Not all high-yield wallets are worth tracking—some may have just been lucky after making a wide range of investments.

Additionally, some traders use tools like Solscan to investigate the initial source of funds in a wallet, helping to determine which “group” the wallet belongs to. In the memecoin market, some smart money addresses might use multiple wallets for transactions, making it essential to track their activities across different addresses.

Once you’ve selected the final wallet addresses, add them to your watchlist and monitor their transaction performance regularly. When you encounter a new memecoin, you can check GMGN’s “Following” feature or use other monitoring tools to see if any of these tracked wallets are holding the coin, providing valuable insights for your trading decisions.

Advanced Gameplay: Chain Scanning + Following Orders

The trading cycle in the memecoin market has been compressed to minutes, so speed is crucial to profitability results. However, it needs to be understood that fast transaction speed does not mean that there will be high profitability returns. There needs to be sufficient Judgment and analysis ability as support.

Players usually compete for speed in three aspects, namely discovering alpha new coins (chain scanning), discovering smart money trends (following orders) and final buying and selling (trading).

Chain Scanning

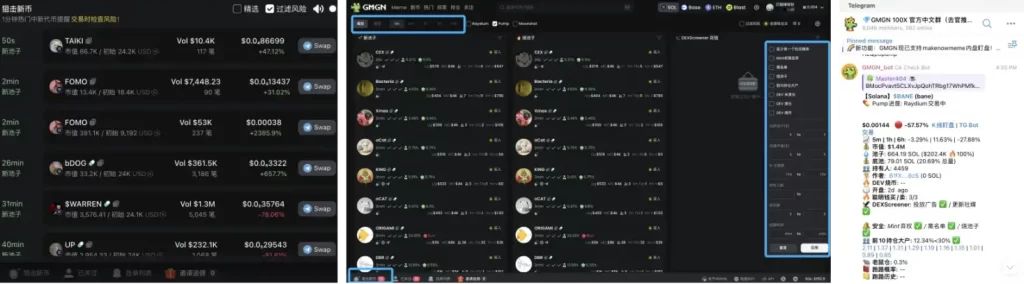

In terms of “chain scanning”, GMGN and Bullx are more popular.

GMGN displays the “Sniping New Coin” column at the bottom of the page. When a signal occurs, a red prompt will appear, and users can click to view it immediately. Click “New Coins” on the GMGN homepage to browse the latest token status. You can set filtering conditions on the right side, including whether there is social media, DEX holdings, circulating market value, number of holders, etc. However, some users have reported that the filtering conditions sometimes do not work, and they will be used in conjunction with TGBOT officially provided by GMGN.

Bullx is a decentralized trading platform covering six networks: Ethereum, Solana, BNB Chain, Arbitrum, Base and Blast. Its unique feature is that it provides two trading methods, web and Telegram bot, with key functions such as fast trading, limit order setting, smart MEV protection, new token sorting and filtering, and Pump Fun scanner.

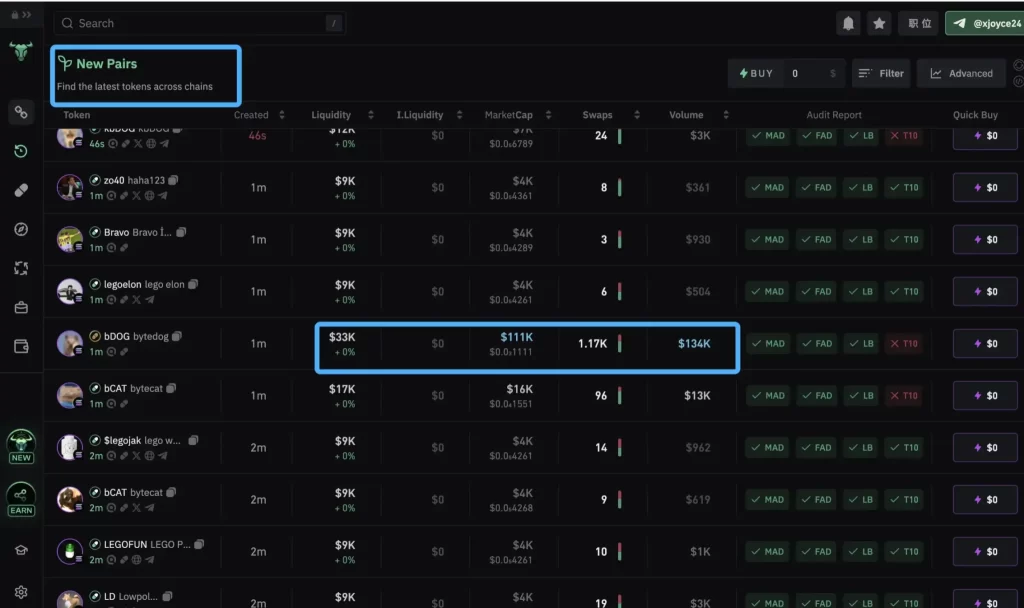

Users can click “chain” to choose to view only the new currency updates of Solana and Ethereum chains. Click “New Pairs” to display the latest 30 tokens monitored online. The earliest token on this page is usually online 2 minutes ago. The indicators that can be viewed are token creation time, token liquidity, market value, number of transactions, transaction volume and basic contract security reports. Bullx will highlight abnormal data so that users can discover new alpha coins as soon as possible.

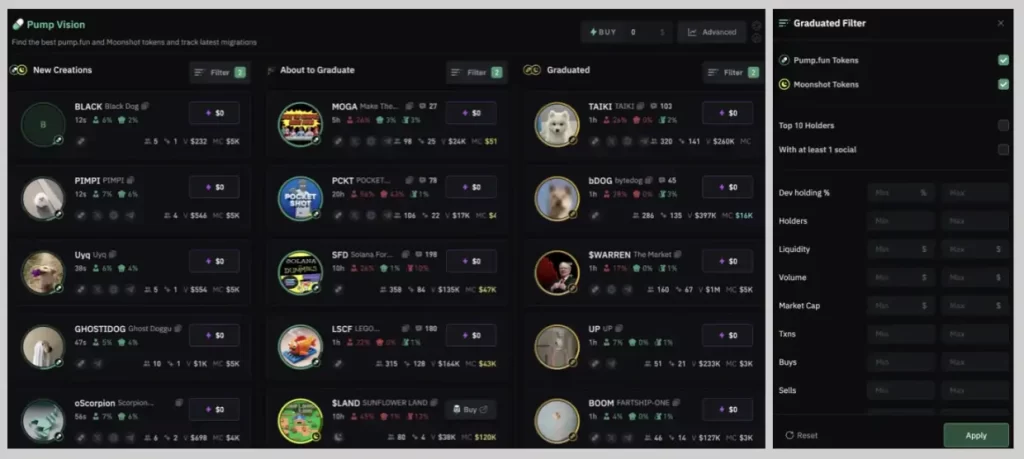

In addition, Bullx also opened a special “Pump Vision” column, which displays the token dynamics on Pump.fun and Moonshot in three categories: new pool, internal market about to be filled, and just filled. Users can also filter tokens again under each category based on dimensions such as dev holding ratio, number of currency holders, liquidity, trading volume and market capitalization.

Judging from the feedback of community users, the advantages of Bullx are smooth interaction, outstanding advantages in viewing new coins that appear within a few minutes, and the ability to support pending order transactions. However, the disadvantage is that sometimes lags occur, and there is no smart money identification function, so only basic position structure analysis can be performed.

In terms of fees, BullX charges 1% per transaction, and if users sign up through referrals from other users, they can enjoy a 10% fee discount, which means BullX deducts a 0.9% fee. BullX also has a currency issuance plan, and the second season airdrop plan is in progress. Users can receive corresponding rewards based on accumulated early bird points. Not long ago, Whales Market announced the listing of BullX (BULLX) on its Pre-Market.

Follow Orders

“Following orders” is a group phenomenon that cannot be ignored in the memecoin market. Many memecoin traders hope to grasp the status of smart money transactions as soon as possible. Both GMGN and NFT Sniper have the ability to build their own watchlists.

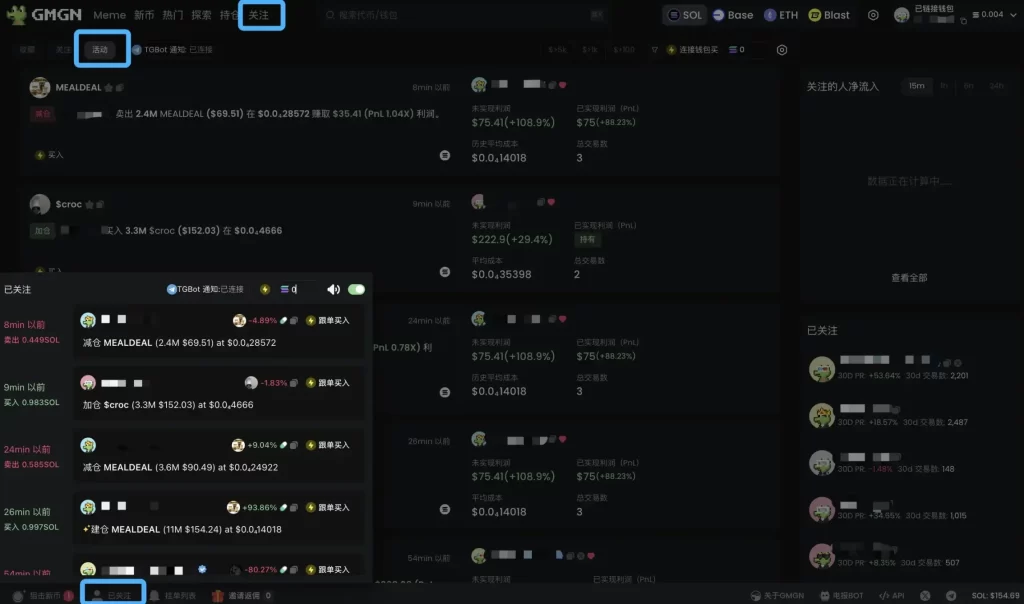

Click “Track” on the GMGN page to view the list of wallets you are tracking. Click “Activity” to display the trends of the addresses you are following in chronological order. GMGN not only provides address trends, but also displays the purchase cost of the wallet addresses you follow. Realized profits and unrealized profits.

In addition, GMGN has also set up a “Following” column at the bottom left of the page to allow users to capture smart money trends at the first time.

Some tools provide more concise feedback on address changes, giving users a more responsive experience. Some tools have some stage advantages, such as identifying more comprehensive KOL addresses.

Trade

The tools GMGN and Bullx mentioned above both provide trading functions. The following pictures are the trading interfaces of GMGN, Bullx and a certain tool respectively. All three have basic custom slippage, smaller fixed amount buying, and batch Functions such as selling are somewhat different in terms of specific experience.

GMGN displays the real-time profit situation near the trading operation button, which can assist users in deciding the need to sell based on the profit situation. Another tool can provide functions such as multi-wallet synchronization operations and random amount transactions within a set range, which is suitable for users with more customized transaction needs. Bullx allows users to place trading orders, but considering that the liquidity of memecoin trading pairs is generally not deep enough, for some memecoin players, the pending order function is of little practical use.

For the trading needs of mobile devices, the above tools are equipped with corresponding TGBOT services. Some memecoin players also use specialized trading bots, such as Pepeboost, Bonkbot, MaestroBots, Trojan and CAshbot.

Since using bot tools requires a layer of service fees, most memecoins have a small market value and are more suitable for users with small capital to participate. Therefore, players also need to make some balance considerations in terms of speed and cost.

In general, the memecoin market places higher demands on traders’ keen insights and quick responses. Using tools can greatly improve a trader’s chances of survival and profit in the memecoin market. But learning to use these tools is only the first step. Real success also requires a lot of time and energy to develop a deep understanding of the memecoin market. Readers need to analyze and apply it according to their own specific situations and cannot blindly copy it.

Finally, the cryptocurrency market is a high-risk and volatile market, and this is especially true for the memecoin market. This article only provides some reference information for readers who have memecoin trading needs, but it cannot guarantee the winning rate of the transaction. Traders should remain fully cautious and do not make investments that exceed their risk tolerance.