Nearly half of all the corporate money being pumped into this year’s election is coming from the crypto industry, according to a new report from the nonprofit watchdog group, Public Citizen.

This is astonishing! New data has just emerged, showing that the crypto industry is outspending Big Oil, the big banks, and even Koch Industries in contributing to this year’s election. This spending is occurring on both sides of the political spectrum and involves companies you’re likely familiar with.

The crypto sector, which has been under high scrutiny by the Biden administration, is outspending Big Oil and banks this election cycle, with Koch Industries in a distant second place in terms of corporate contributions. Heavyweights like Coinbase, Ripple, and the venture capital firm Andreessen Horowitz, which has a sizable crypto portfolio, have collectively contributed more than $146 million. Their goal is to get candidates who are friendly to the industry into office.

Most of that corporate money is being raised for the popular bipartisan pro-crypto Super PAC called Fairshake, which is one of the top-spending PACs this year.

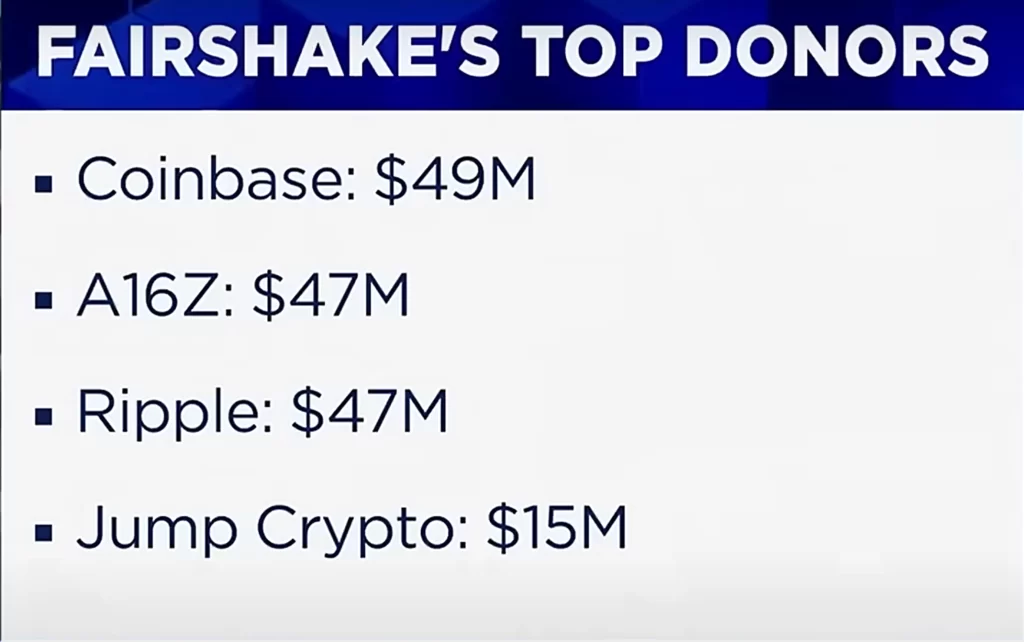

CNBC spoke to their team to get the latest numbers on the four largest donors to Fairshake and its associated PACs. Coinbase has contributed $49 million, Andreessen Horowitz and Ripple have both given $47 million each, and Jump Crypto has put in $15 million.

It’s important to note that this money is not just going to one side of the political spectrum. While probably a little more has been donated to Trump from the crypto community, this isn’t just for presidential candidates; it’s for senators and congressmen too. This funding is being distributed to both sides.

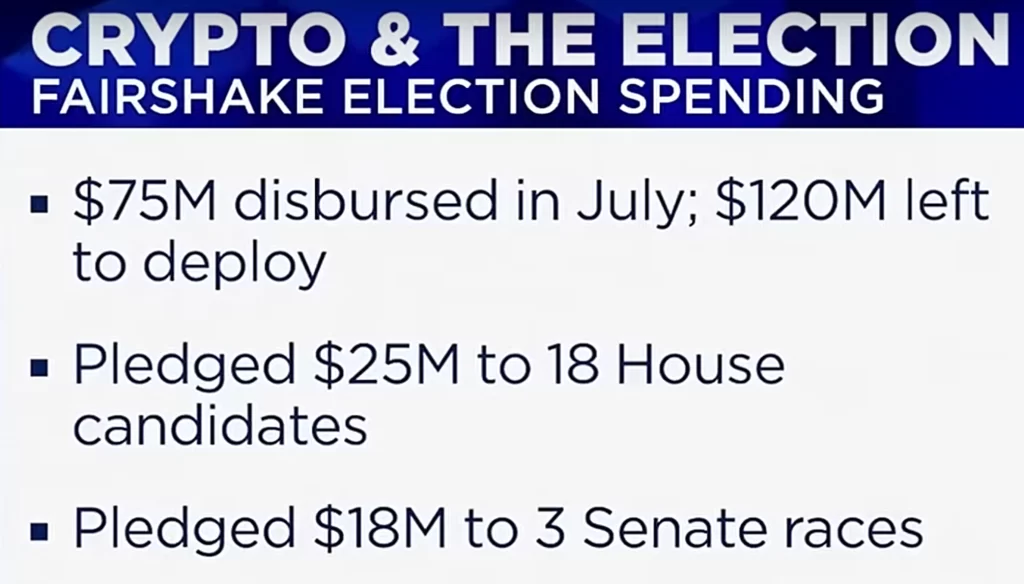

As for where all that money is going, a filing with the Federal Election Commission this week showed that in July, Fairshake disbursed almost $75 million and still has nearly $120 million left to deploy, with 73 days to go until the November election.

The Super PAC has pledged $25 million from that pool of cash to 18 House candidates in the general election, to be split among nine Democrats and nine Republicans. It has also committed another $18 million to three Senate races.

Before we get to crypto news, let’s address a related issue: the very ethos of Telegram, a platform that does not believe in censorship. This potential super cycle is much bigger than political donations.

Bitcoin ETF Inflows Surge

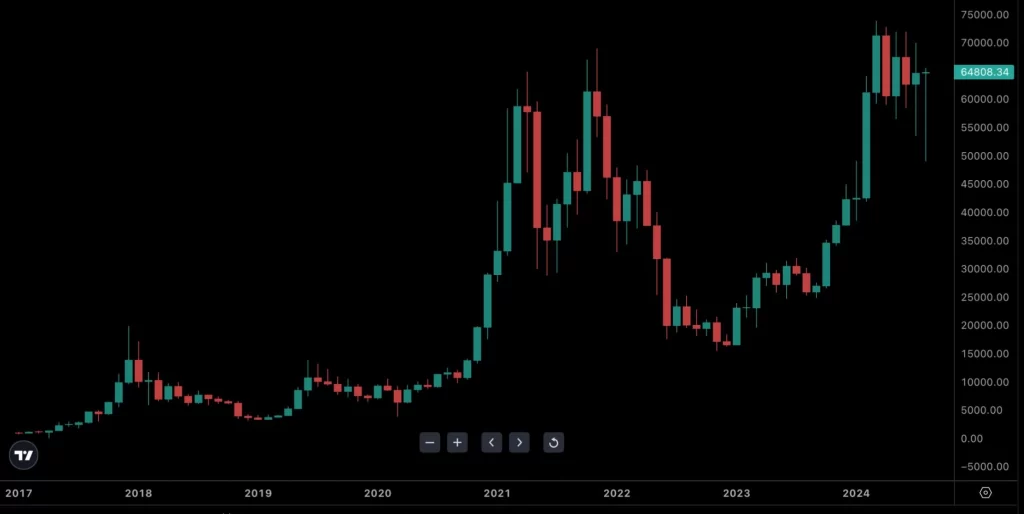

The biggest Bitcoin ETF inflows in the last three weeks, showing that when Bitcoin dipped, it was bought up so aggressively and quickly. This is arguably the most interesting monthly candle in Bitcoin’s history. It’s easy for people to buy it, and it can be stored on their brokerage account with a quick number.

As you know, because you and I have been on Wall Street a long time—this is my 35th year on Wall Street—Wall Street is a selling machine, and they haven’t even amped up that selling machine yet. But just imagine tens of thousands of financial advisors out there explaining to people that they need a position like this in their portfolio.

It’s coming, and Wall Street investor and political insider Anthony Scaramucci does a great job explaining why Bitcoin, today in the low $60,000s, is most likely going much higher. The regulatory clearance for the ETF made it safe to go into Bitcoin for lots of institutional investors. Even places like Morgan Stanley are now allowing their financial advisors to solicit people on Bitcoin.

BlackRock have got $23 billion in crypto assets; it’s the most successful ETF launch in history. This is paving the way and making it more acceptable. It’s been very meaningful. If you had said to me last year when Bitcoin was in the 30s that we’d be here in the 60s post-halving, I think most people in the industry would be very happy.

Bitcoin’s Future Potential

Buying Bitcoin today could be an easy 10x on your money, says billionaire Michael Saylor. The best idea if you want to make 10x your money is to buy something that everybody in the world needs, that nobody in the world can stop, and that almost nobody understands—much like buying Amazon stock or Google stock back in 2010.

In 2010, that was Amazon, Apple, Facebook, or Google. These were all dominant digital networks that everybody in the world needed, that nobody could stop.

But if you’d asked the typical mainstream investor whether this was a good investment, they would all say, “Oh, it’s very scary; it’s overvalued. Amazon doesn’t make money.”

You know, mobile phones used to cost $50. People said, “Apple is going to sell an iPhone for $600? That’s too expensive! Nokia will sell me one for $30.” They said Apple would go to $30, and of course, what happened? Apple went to $1,500. The conventional wisdom was against these big tech companies.

Telegram and Its Founder’s Legal Battle

In breaking news, Telegram founder Pavel Durov has been arrested in France and now faces 20 years in prison for refusing to censor his platform. He has been detained by the office that is “preventing violence against minors,” which had previously issued an arrest warrant for Durov in a preliminary investigation.

The alleged offenses include fraud, drug trafficking, cyberbullying, organized crime, and the promotion of terrorism. He is accused of failing to take action to curb the criminal use of his platform.

The investigator said, “Enough of Telegram’s impunity,” adding that they were surprised Durov came to Paris knowing he was a wanted man.

This situation raises important questions: Does the founder of the platform deserve to be charged for crimes he did not commit, but which were committed on his platform? While I do not condone criminal activity and believe those criminals deserve to be punished, it does seem that these single points of failure, like a CEO who isn’t even the CEO of Toncoin, just Telegram, will always be dragged in if your platform gets big enough.

What do regulators do in response to a system that cannot be regulated? They regulate the bits they can: the exchanges, the bank accounts, the national currency side of things. They shut down the on-ramps and off-ramps, saying, “We will not let you take your money with you.”

The Rise of Digital Currency

And what do Millennials say to that? “Dude, I don’t have any money. All I have is my creative potential, my spirit, my productivity, and I can sell that directly for Bitcoin without an exchange, without an onramp, without an offramp. And when I need to buy something, I’ll use my digital currency directly without re-entering your system, to which I was never invited.”

Shut down the on-ramps and off-ramps, and I will stay on board. I will stay digital. I will not touch your gilded cage anymore because I don’t need you.

This perspective is echoed by Andreas Antonopoulos, who spoke about how you can’t censor the underlying Bitcoin protocol, but regulators can come after the centralized aspects of the ecosystem.