Expand Summary

Cathie Wood’s investment advice and strategies, characterized by thematic investing and bold price predictions, are polarizing, with some viewing her as a visionary and others as overly optimistic, reflecting broader debates on investment approaches and gender dynamics in finance.

Abstract

Cathie Wood, the founder of ARK Invest, is a divisive figure in the investment world, known for her thematic investing approach and her ability to attract both fervent supporters and harsh critics. Her predictions and investment choices in cutting-edge technology and science sectors have led to significant fluctuations in her fund’s performance, with some investors applauding her foresight and others questioning her lack of direct experience in these fields. Despite facing misogyny and skepticism, Wood has maintained her investment philosophy, arguing that her contrarian views are the source of any professional marginalization rather than her gender. Her strategy, which includes making price predictions—a taboo in traditional finance—has been both a marketing boon and a source of controversy. While her fund has experienced substantial losses, her long-term vision aligns with the increasing digitalization and technological advancements, suggesting that the true measure of her investment acumen may only be evident over extended periods.

Opinions

- Polarizing Perspectives: Some investors dismiss Wood’s advice, with comments reflecting misogynistic attitudes, while others praise her as a pioneer and visionary in the financial industry.

- Misogyny in Finance: The article highlights instances of misogyny directed at Wood, suggesting that her gender plays a role in the public’s perception and criticism of her investment strategies.

- Criticism of Performance: Critics point to Wood’s underwhelming performance while at Alliance Bernstein and the significant downturn in ARK Invest’s value as evidence of her investment approach’s shortcomings.

- Defense of Investment Philosophy: Wood attributes any professional marginalization to her disruptive investment strategies rather than her gender, emphasizing her focus on solving pressing global issues through investment.

- Marketing Genius or Overconfident Predictor: Her willingness to make price predictions is seen as either a clever marketing strategy or a risky move that could potentially harm investors, depending on one’s perspective.

- Long-Term Vision: The article suggests that Wood’s investment strategy should be judged over the long term, considering the potential for exponential growth in emerging technologies, despite short-term volatility and losses.

- Risk Management Concerns: There are concerns about Wood’s approach to risk management, with critics arguing that her reliance on instincts without employing risk-management staff is detrimental to investors.

- Resilience and Conviction: Despite criticism and significant capital loss, Wood remains committed to her investment philosophy, maintaining positions in companies like Coinbase, Tesla, Zoom, and Roku, which she believes will outperform in the long run.

Cathie Wood polarises people.

She’s a career-long investor and a lightning rod for criticism.

It’s largely down to her Helter Skelter stock performance, her brazen out-of-left-field price predictions, and, to put it mildly, the fact that she’s a female in a male-dominated environment.

There, I said it.

I often get asked how I come up with these headlines. Well, here it is.

I read comments on the blogs I write, then use the language and topics from those comments to craft follow-up blogs that resonate directly with readers.

I take the general sentiment of what people are saying and then write an impactful headline.

Here are some actual comments from people:

“Why would anyone listen to this witch.”

“How can you take this woman seriously.”

“It has nothing to do with her being a woman. She’s just terrible”.

You can almost taste the misogyny.

Wood has come out publicly in response to these types of comments, saying she attributes any professional marginalisation to her contrarian views about investing rather than her gender:

“People say that I am attacked in the media because I’m a woman. I don’t think that is. I really think it’s because we’re disrupting the financial world, and we’re unsettling people.”

But it’s like an old cricket coach used to tell me, “Jay, you can only control the controllables.”

This rationalisation is what I see Cathie do to distance herself from things that are mostly toxic and out of her influence.

One financial analyst called her “The world’s best con artist” after her fund ARK investment crashed by 70%, wiping away $60 billion in value for average American investors while still pocketing the benefits of her 0.75% fee structure, making approximately $450 million.

The World Renowned Asset Manager also earned applause from many.

One Investor described Wood as “The Warren Buffett but for the Game Stop generation because she sees the future before the Street does.”

It’s led to this crowd dubbing her “Cathie Bae” on Reddit. An affectionate term meaning “before anyone else”.

Wood is a social media marketer’s dream because in an industry hesitant to make promises about the future, her brand sells price-prediction erotica to the masses.

People hang off her dopamine-fueled buzzwords like Crack addicts ready to plough their last dollar in whatever she recommends next.

The main criticism levelled at her is that she’s yet to spend a day working in the technology or science sector, but she’s now a “pioneer” investing in these areas.

Wood’s strategy can be categorised as “Thematic Investing”.

It’s a style of investing that focuses on specific trends or themes, like clean energy or artificial intelligence.

People have questioned her experience in these industries and see her as this Wall Street predator injecting a ‘to-the-moon’ mentality into a generation of amateur investors.

While working for Alliance Bernstein from 2001 to 2013, she made a poultry 0.81% return for her investors, which didn’t even cover the 3% fee she continued to take.

The origin story of her founding Ark Invest is biblical and somewhat strange because she said Jesus called her, and “It was a divine intervention.”

When people use religion as a vessel to justify things that can be measured through math or sheer logic, it scares me sh*tless.

But whether or not anyone wants to acknowledge it, she is a marketing genius. Wood cleverly breaks one sacrosanct rule in traditional finance: never make price predictions.

So, she does. And it’s her lead marketing tactic.

It’s both a risk and a blessing: her predictions may backfire, yet they also attract outsized attention to her fund because, right or wrong, she’s always in the headlines.

Investing has become culturally significant, something we do, and people see Wood and what she says as a considerable safety signal.

When we sat at home while it rained bat virus money on us, Bloomberg voted Wood the best stock picker “by a distance”.

Watching people loop back around, drenched in criticism, feels wild and unpredictable.

Here was her victory speech.

Cathie Wood — Source

“The coronavirus posed numerous challenges, but our portfolios thrive on solving problems. Our investors have been rewarded for addressing some of the world’s most pressing issues. I enjoy introducing fresh perspectives and showing how the world will evolve in investment portfolios and personal lives. It’s about guiding everyone toward positive change and capitalising on exponential growth trends.”

Final Thoughts.

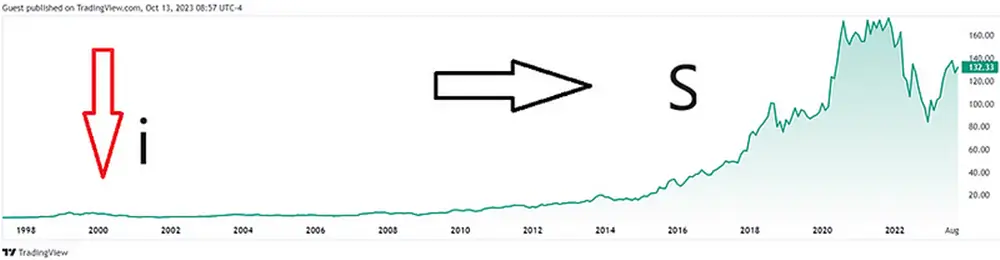

Emerging technologies can languish for years.

Amazon took six years to recover from the Dot Com bubble bursting and almost 14 years to achieve consumer adoption.

Amazon’s market cap rose from around $100 million in its first bull run during the dot-com bubble in 2000 to over $1.8 trillion.

That’s an increase of 18 thousand per cent (18,000%).

It’s called the I S-curve in investing, and it often takes a long time to unfold, with significant volatility along the way.

So the core question is, why are we measuring the results in the first quarter of play?

Why are people surprised that assets with parabolic price rises see the largest capitulations?

I get why some may feel misled by her “perma-bull” stance during the bull market peak, but investing is a marathon, and you’d be making a huge mistake ignoring Cathie Woods’s advice.

We are only going further into technology and emerging trends and becoming more digitalised, not less.

Wood likely lost a significant amount of her investors’ value in the short term, but when you chase outsized results, you have to expect the volatility that comes with it.

Morningstar, a fund-rating company, wrote a scathing review of her haphazard disregard for risk and how not employing any risk-management staff hurt investors.

“Wood’s reliance on her instincts to construct the portfolio is a liability,”

If you invest in her fund, you have to be comfortable with the fact that the highs are going to be high and the lows are going to be low.

Wood faced criticism, with people saying she’d lost her touch, but she stayed the course.

Now, with capital in companies like Coinbase, Tesla, Zoom, and Roku, she is poised to outperform everyone.

It just might unfold at a slower pace than you think.